With effect from 1st July 2020, Germany has decided to lower their VAT rates to help boost the economy after COVID-19 and it is quite likely that other countries will follow in their footsteps.

- Standard rate is to be reduced from 19% to 16%

- Reduced rate is to be reduced from 7% to 5%

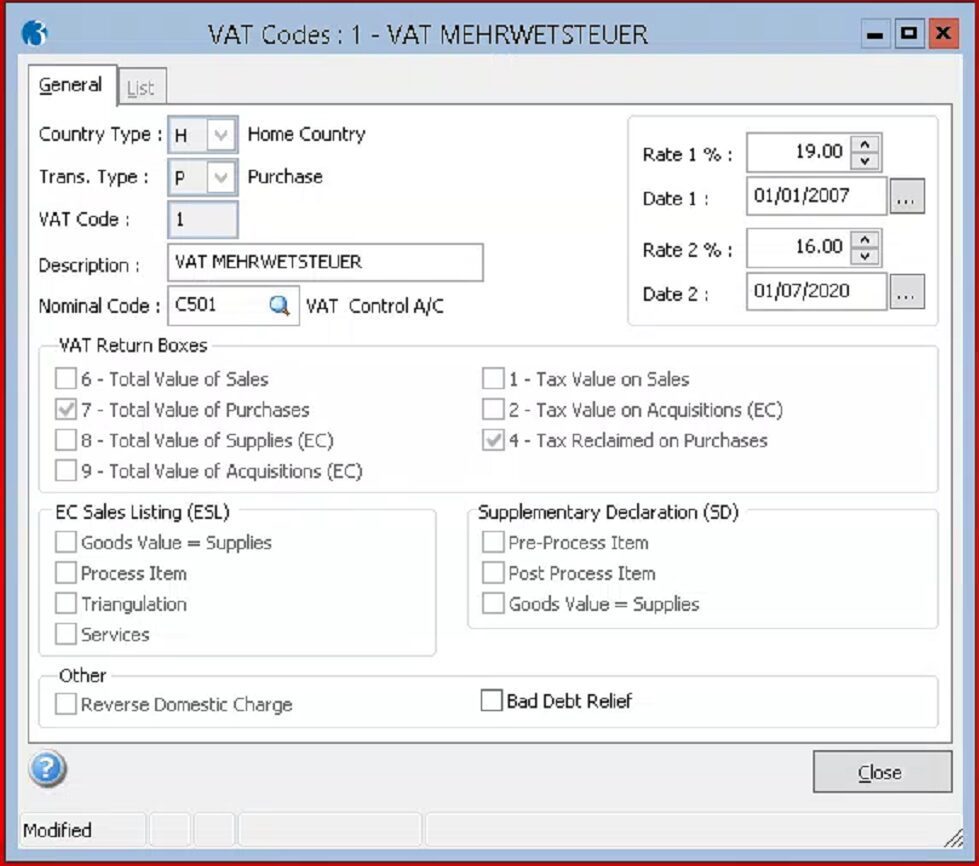

The good news is, if you charge German VAT then you can amend Opera 3 yourselves. All you have to do i follow the two steps below:

- Simply access the VAT codes under VAT Processing from the Opera 3 system menu

- Then for each German VAT code on the system enter the new rate in Rate 2% and the start date in the Date 2 field

The new rate will automatically come in effect from this date.

If you are having any trouble please get in contact with your technical adviser who will be able to assist.

Written By Tom Race.